Tax Specialist

Tao Foods Company Inc.

職務内容

福利厚生

手当

通信費手当

福利厚生

クリスマスボーナス, 社員ローン, 住宅ローン基金, 有給休暇, 医療給付金, SSS/GSIS

休暇

出産・育児休暇, 病気休暇

Qualifications:

- Bachelor’s degree in Accountancy, Finance, or related field.

- Certified Public Accountant (CPA) license is an advantage but not always required.

- At least 2–3 years relevant experience in taxation, accounting, or auditing.

- Strong knowledge of Philippine Tax Laws, BIR regulations, and other applicable compliance requirements.

- Proficient in MS Excel, accounting software (e.g., SAP, QuickBooks, Xero), and tax filing platforms (e.g., eFPS, eBIRForms).

- Excellent analytical skills, attention to detail, and problem-solving abilities.

- Strong communication skills for coordination with government agencies and internal departments.

- High level of integrity and confidentiality.

Responsibilities:

- Prepare and file BIR returns and other government-required tax reports.

- Ensure compliance with all tax regulations and deadlines.

- Maintain accurate records of tax-related documents and transactions.

- Provide advice on tax implications of business operations and transactions.

- Coordinate with auditors, external consultants, and BIR representatives.

- Monitor changes in tax laws and update management accordingly.

Qualifications:

- Bachelor’s degree in Accountancy, Finance, or related field.

- Certified Public Accountant (CPA) license is an advantage but not always required.

- At least 2–3 years relevant experience in taxation, accounting, or auditing.

- Strong knowledge of Philippine Tax Laws, BIR regulations, and other applicable compliance requirements.

- Proficient in MS Excel, accounting software (e.g., SAP, QuickBooks, Xero), and tax filing platforms (e.g., eFPS, eBIRForms).

- Excellent analytical skills, attention to detail, and problem-solving abilities.

- Strong communication skills for coordination with government agencies and internal departments.

- High level of integrity and confidentiality.

Responsibilities:

- Prepare and file BIR returns and other government-required tax reports.

- Ensure compliance with all tax regulations and deadlines.

- Maintain accurate records of tax-related documents and transactions.

- Provide advice on tax implications of business operations and transactions.

- Coordinate with auditors, external consultants, and BIR representatives.

- Monitor changes in tax laws and update management accordingly.

Jhun Guerrero

HR OfficerTao Foods Company Inc.

今日 0 回返信

勤務地

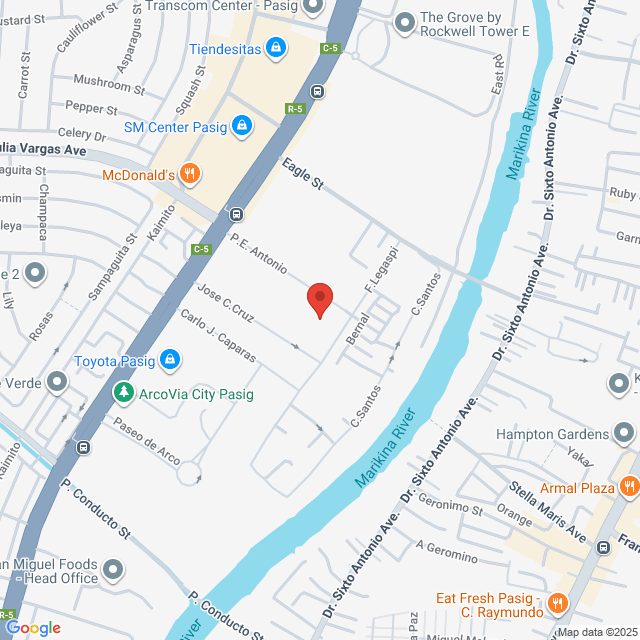

2nd, #90 P.E. Antonio. #90 P.E. Antonio, Pasig, 45221 Metro Manila, Philippines

掲載日 08 August 2025

類似の求人

さらに表示するTax Officer

WONESE Philippines

WONESE Philippines£579-708[月給]

オンサイト - パシグ3年以上5年未満の経験大卒正社員

ANGEL JOY MAASSr. Recruitment Specialist

Tax and Bookkeeping Associate

Starlight Business Consulting Services, Inc.

Starlight Business Consulting Services, Inc.£322-386[月給]

オンサイト - マカティ1年以上3年未満の経験大卒正社員

Joy de BelenHR Officer

Tax Specialist

LSERV Corporation

LSERV Corporation£193-258[月給]

オンサイト - サンファン新卒/学生大卒正社員

Kathrine antipuestoTalent Acquisition Specialist

Tax Specialist

Mint HR Philippines Corporation

Mint HR Philippines Corporation£322-386[月給]

オンサイト - モンテンルパ1年以上3年未満の経験大卒正社員

Mint HR PhilippinesFounder

Tax Specialist

ABIC Manpower Service Corp.

ABIC Manpower Service Corp.£258-322[月給]

オンサイト - マカティ1年以上3年未満の経験大卒正社員

ABIC Manpower Service CorpHuman Resources & Recruitment